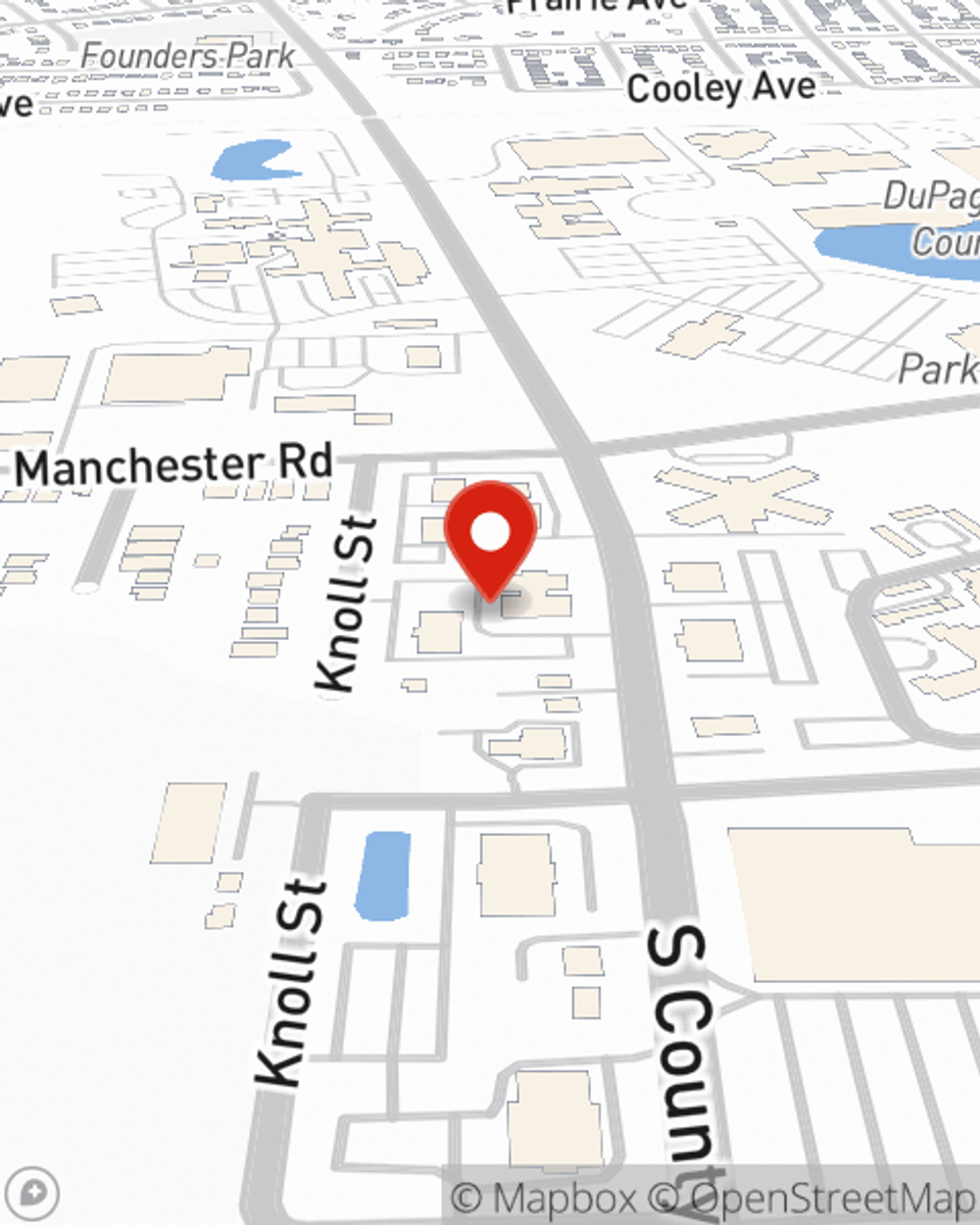

Insurance in and around Wheaton

Bundle policies and save serious dollars

Customizable coverage based on your needs

Would you like to create a personalized quote?

Celebrating 100 Years Of Good Neighboring

Life is often unpredictable. We understand your wish to help protect what matters most. With State Farm insurance, you can develop a Personalized Price Plan® that's right for you, your loved ones, and the life you've built. Contact agent Skip Sorensen with your questions about safe driving rewards, and bundling options and discounts.

Bundle policies and save serious dollars

Customizable coverage based on your needs

Insurance Products To Meet Your Ever Changing Needs

If you're looking for outstanding coverage options, great claims service, and competitive prices, look no further. State Farm is the largest insurer of automobiles and homes in the U.S. for a reason.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Attention teen drivers: Buckle up for seat belt safety

Attention teen drivers: Buckle up for seat belt safety

Teen drivers sacrifice important protection when they don't buckle up. Help make seat belt safety a habit with tips from this video.

Skip Sorensen

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Attention teen drivers: Buckle up for seat belt safety

Attention teen drivers: Buckle up for seat belt safety

Teen drivers sacrifice important protection when they don't buckle up. Help make seat belt safety a habit with tips from this video.